If you are 70½ years old or older, you can take advantage of a simple way to benefit Colorado Public Radio and receive tax benefits in return. You can give up to $100,000 from your IRA directly to a qualified charity such as ours without having to pay income taxes on the money. This law no longer has an expiration date so you are free to make annual gifts to our organization this year and well into the future. Why Consider This Gift?. Your gift will be put to use today, allowing you to see the difference your donation is making.

- Elecard Stream Analyzer

- Elecard Stream Analyzer Keygen For Mac Download

- Elecard Stream Analyzer Keygen For Mac Mac

You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions. If you have not yet taken your required minimum distribution for the year, your IRA charitable rollover gift can satisfy all or part of that requirement. Frequently Asked Questions Q. I've already named Colorado Public Radio as the beneficiary of my IRA.

What are the benefits if I make a gift now instead of after my lifetime? A. By making a gift this year of up to $100,000 from your IRA, you can see your philanthropic dollars at work. You are jump-starting the legacy you would like to leave and giving yourself the joy of watching your philanthropy take shape. Moreover, you can fulfill any outstanding pledge you may have made by transferring that amount from your IRA as long as it is $100,000 or less for the year. I'm turning age 70½ in a few months.

Elecard Stream Analyzer

Can I make this gift now? The legislation requires you to reach age 70½ by the date you make the gift. I have several retirement accounts—some are pensions and some are IRAs.

Does it matter which retirement account I use? Direct rollovers to a qualified charity can be made only from an IRA.

Under certain circumstances, however, you may be able to roll assets from a pension, profit sharing, 401(k) or 403(b) plan into an IRA and then make the transfer from the IRA directly to Colorado Public Radio. To determine if a rollover to an IRA is available for your plan, speak with your plan administrator. Can my gift be used as my required minimum distribution under the law?

A. Yes, absolutely. If you have not yet taken your required minimum distribution, the IRA charitable rollover gift can satisfy all or part of that requirement. Contact your IRA custodian to complete the gift. Do I need to give my entire IRA to be eligible for the tax benefits?

You can give any amount under this provision, as long as it is $100,000 or less this year. If your IRA is valued at more than $100,000, you can transfer a portion of it to fund a charitable gift. I have two charities I want to support. Can I give $100,000 from my IRA to each?

Under the law, you can give a maximum of $100,000. For example, you can give each organization $50,000 this year or any other combination that totals $100,000 or less. Any amount of more than $100,000 in one year must be reported as taxable income. My spouse and I would like to give more than $100,000. How can we do that?

A. If you have a spouse (as defined by the IRS) who is 70½ or older and has an IRA, he or she can also give up to $100,000 from his or her IRA. It is wise to consult with your tax professionals if you are contemplating a charitable gift under the extended law. Please feel free to contact Joann Wooley at 303-871-9191, Ext. 312 or with any questions you may have. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change.

State law may further impact your individual results. Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance. A charitable bequest is one or two sentences in your will or living trust that leave to Colorado Public Radio a specific item, an amount of money, a gift contingent upon certain events or a percentage of your estate.

An individual or organization designated to receive benefits or funds under a will or other contract, such as an insurance policy, trust or retirement plan Bequest Language 'I, name, of city, state, ZIP, give, devise and bequeath to Public Broadcasting of Colorado, dba Colorado Public Radio, doing business as Public Broadcasting of Colorado, dba Colorado Public Radio,written amount or percentage of the estate or description of property for its unrestricted use and purpose.' . Federal Tax ID Number: 74-232-4052 able to be changed or cancelled A revocable living trust is set up during your lifetime and can be revoked at any time before death.

They allow assets held in the trust to pass directly to beneficiaries without probate court proceedings and can also reduce federal estate taxes. Cannot be changed or cancelled tax on gifts generally paid by the person making the gift rather than the recipient the original value of an asset, such as stock, before its appreciation or depreciation the growth in value of an asset like stock or real estate since the original purchase the price a willing buyer and willing seller can agree on The person receiving the gift annuity payments. The part of an estate left after debts, taxes and specific bequests have been paid a written and properly witnessed legal change to a will the person named in a will to manage the estate, collect the property, pay any debt, and distribute property according to the will A donor advised fund is an account that you set up but which is managed by a nonprofit organization. You contribute to the account, which grows tax-free.

You can recommend how much (and how often) you want to distribute money from that fund to Colorado Public Radio or other charities. You cannot direct the gifts. An endowed gift can create a new endowment or add to an existing endowment.

The principal of the endowment is invested and a portion of the principal’s earnings are used each year to support our mission. Tax on the growth in value of an asset—such as real estate or stock—since its original purchase. Securities, real estate or any other property having a fair market value greater than its original purchase price. Real estate can be a personal residence, vacation home, timeshare property, farm, commercial property or undeveloped land. A charitable remainder trust provides you or other named individuals income each year for life or a period not exceeding 20 years from assets you give to the trust you create.

You give assets to a trust that pays our organization set payments for a number of years, which you choose. The longer the length of time, the better the potential tax savings to you. When the term is up, the remaining trust assets go to you, your family or other beneficiaries you select. This is an excellent way to transfer property to family members at a minimal cost.

Elecard Stream Analyzer Keygen For Mac Download

You fund this type of trust with cash or appreciated assets—and may qualify for a federal income tax charitable deduction when you itemize. You can also make additional gifts; each one also qualifies for a tax deduction. The trust pays you, each year, a variable amount based on a fixed percentage of the fair market value of the trust assets. When the trust terminates, the remaining principal goes to Colorado Public Radio as a lump sum. You fund this trust with cash or appreciated assets—and may qualify for a federal income tax charitable deduction when you itemize. Each year the trust pays you or another named individual the same dollar amount you choose at the start. When the trust terminates, the remaining principal goes to Colorado Public Radio as a lump sum.

A beneficiary designation clearly identifies how specific assets will be distributed after your death. A charitable gift annuity involves a simple contract between you and Colorado Public Radio where you agree to make a gift to Colorado Public Radio and we, in return, agree to pay you (and someone else, if you choose) a fixed amount each year for the rest of your life.

. FSS Video Converter is a free and powerful tool that allows convert all popular video formats, including HD video. Free program that converts AVI, DivX, Xvid files to MP4 format. MP4 files created by the program can be played on many portable devices (iPhone, iPod, Samsung Galaxy, Microsoft Surface, HTC, PSP).

Convert MKV files to MP4 videos. WinX Free MP4 to AVI Converter is a perfect free MP4 to AVI converter that converts MP4 to AVI for free. Besides free converting MP4 to AVI, this high-quality MP4 to AVI conversion freeware also enables user to extract images from AVI video to PNG. Leawo PowerPoint to FLV converter can perfectly retain original elements to easily convert PowerPoint to flash video FLV, MP4, MOV, 3GP/3G2 and YouTube resolution file, so that PowerPoint file can be easily enjoyed on YouTube and flash video player. Freeware application that converts iPod / PSP movies (MP4, M4V and MP4V) to AVI or MPG.

That files can be played with any video player. Video Streaming Recorder for Movies from Online Video Services, Series from TV Media Players and Website Videos. Video Converter for PC, Smartphone, Tablet, Apple iPhone, iPad +, DVD Copier and Private Video Library.

Leawo Video Converter for Mac allows you to convert all popular video files including MP4, AVI, VOB, 3GP, MOV, MPEG, etc. To video formats like MP4, MOV, AVI, etc. It also converts video to audio file in formats like MP3, AAC, WMA, WAV, etc. Elecard StreamEye Basic Latest Version Product Review: Elecard StreamEye Basic – video quality test software for QA, technical support, and system integration teams dealing with video compression quality assurance, encoder settings adjustment or selection of best codec.

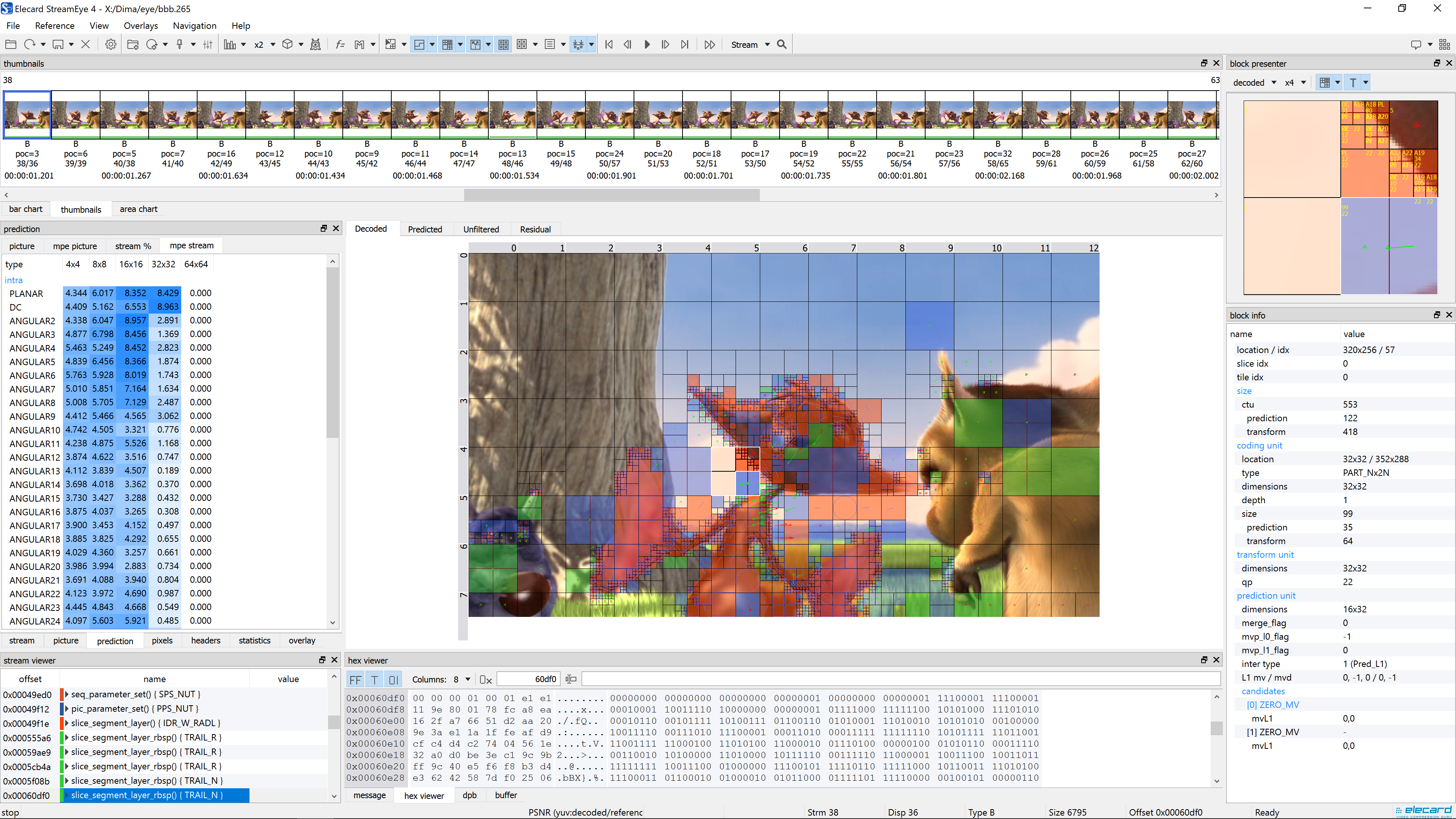

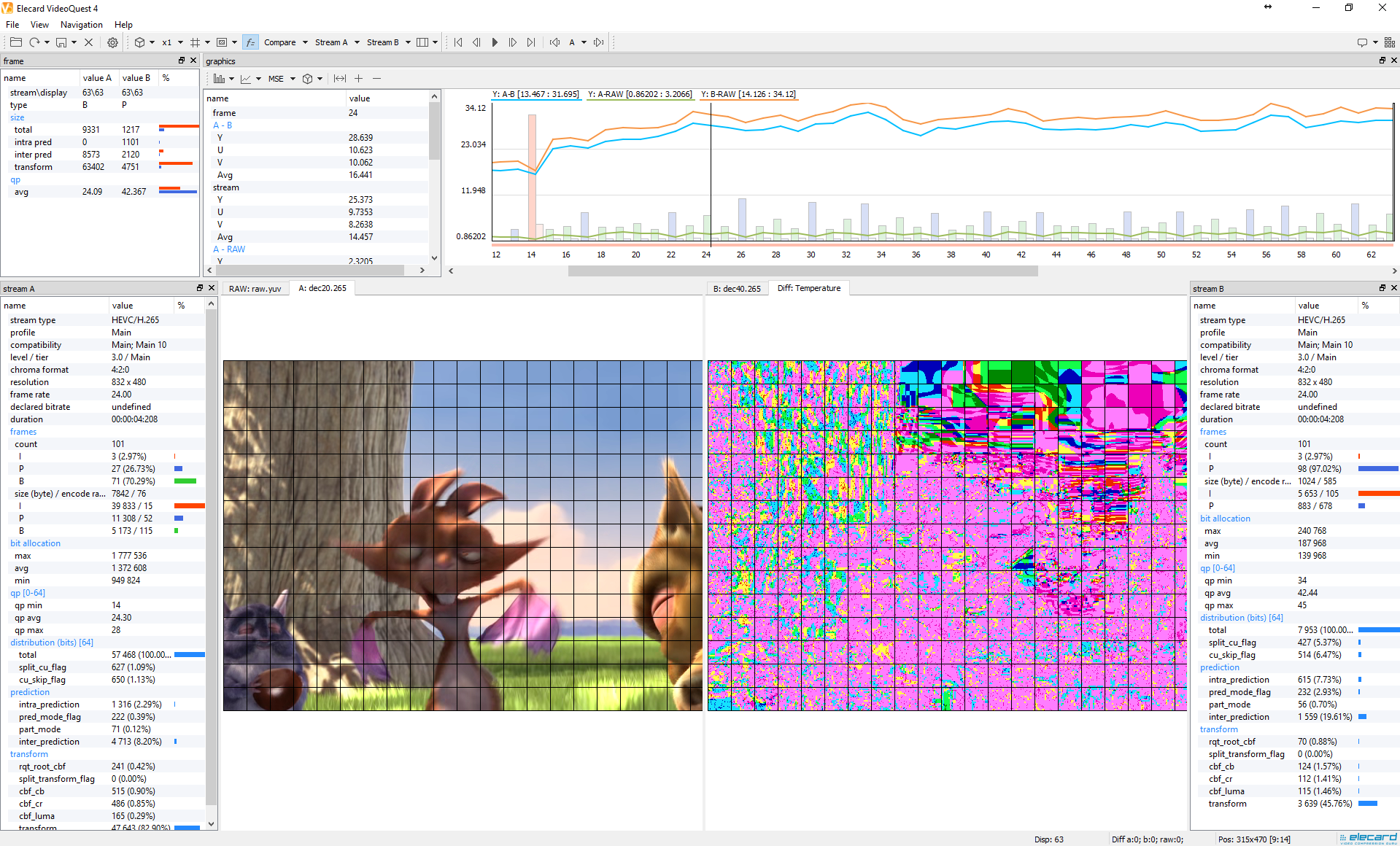

StreamEye Basic offers key features of StreamEye for effective video compression quality verification and does a great job in localizing inefficiencies in the encoded streams. Stream Summary informaion: Profile, compatibility flags, level, tier, chroma format, resolution, frame rate, duration, frame types, average frame sizes; range of quantizer values; bit allocation info. Picture information: CU, PU, TU size; max min QP; pixel distribution into encoded type: intra, inter, and skip; motion vectors range. Elecard StreamEye Basic 64 bit, 32 bit Main Features Main features include:. Elecard StreamEye Basic 2018 latest version. Easy to use. Offline setup, 64 bit and 32 bit Support.

Virus checked and safe., 7 and other prevoius windows versions. How to uninstall (remove) Elecard StreamEye Basic Completely? Windows 10. Go to Start / Settings / Apps & Features. Then search for it & click Uninstall.

Then confirm. Windows 7 & XP. Go to Start / Control Panel / Add/Remove Programs.

Elecard Stream Analyzer Keygen For Mac Mac

Find this app and click Uninstall. Confirm. Disclaimer: Softati.com - does not store or any forbidden files that may cause harm to the original developer. Only free direct download for the original developer distributable setup files.

Elecard StreamEye Basic is developed and maintained by, is not affiliated with this software developers by any means. All trademarks, registered trademarks, product names and company names or logos mentioned herein are the property of their respective owners.

About Article Author.